New income tax for wealthy Texans should be budget priority

On a basic level, state budgets are just like personal finances. There are things you want and ways you plan to pay. But if your budget comes up short, you have to cut from the former or add to the latter — spend less or bring in more money. Simple enough, but the devil is in the details.

For Texas, these details include statistics on public programs. In educational expenses per child we rank 38th among states, according to the National Education Association. Or, in a report by the United States Department of Agriculture, Texas has the second-highest percentage of people with food insecurity. And bust out the foam fingers, because “We’re Number One!”…at releasing carcinogens into the air. Unfortunately, we also have the lowest percentage of citizens with health insurance.

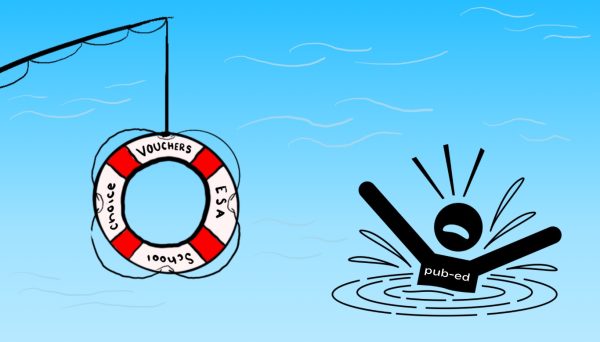

I’m all for balancing the budget, but Texas’ public programs are already so barren that the benefits of the proposed cuts will be far outweighed by the harm to the public well-being. Frankly, if we cut any deeper into public programs — specifically in public school funding and health care — we’re going to start hitting bone.

Only one option avoids seriously jeopardizing the future of these programs and the people who depend on them: raising taxes. Only four states raise less tax revenue than Texas, and Gov. Rick Perry, along with most state legislators and more than 80 percent of Texans, doesn’t want that to change. But let’s give our leaders the benefit of the doubt. They did lead us through times when most other states weren’t faring well. While states like California faced large deficits and widespread unemployment, Texas appeared unscathed under a fiscally conservative approach. Surely the administration has a reason for gutting public education before raising taxes.

The idea of raising taxes during a recession sounds pretty backwards, and in most cases that’s true. If we raised taxes for businesses we could have to deal with problems like decreased economic incentive and small business collapse.

Since Texas ranks fourth in the nation in percentage of citizens living in poverty, raising taxes affecting low-income families would exacerbate poverty. Texas’ majority tax revenue comes from the sales tax, which already hits low and middle-income families harder the wealthy. There’s only one demographic left: high-income Texans.

The wealthiest one percent of Americans account for the largest percent of the federal income tax, but the percent change in their after-tax income over the past 30 years is also three times that of the highest fifth of Americans, 11 times that of the middle fifth, and over 15 times that of the lowest. The income gap between the rich and poor is ninth-largest in the nation. Texas also ranks fifth in income inequality between the middle class and the wealthy.

With numbers like these, wealthy Texans have room to breathe. A small, emergency income tax on the wealthiest two percent would effectively solve the deficit without resorting to debilitating cuts in public programs.

This is not class warfare; it’s patriotism. I don’t propose making such an emergency tax a staple of Texas law; it would simply buy Texas time and money for now.

Wealthy Texans benefited from the state’s business and tax policies during fair-weather times, but now Texas needs someone to hold the umbrella. Who better to do so than those who have benefited the most from Texas’ conservative tax policy?